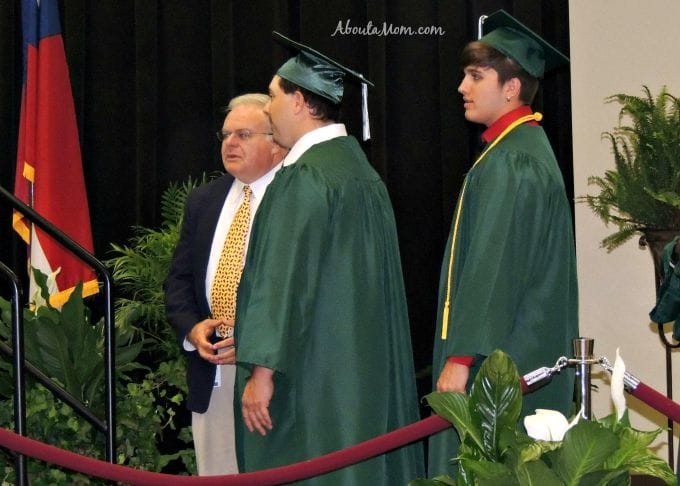

How to pay for your child’s college education is something that weighs on the minds of most parents. With one graduate, one college student and three high schoolers in my family, saving for college is something we discuss a lot.

Most parents want their kids to go to college, yet only half are actively saving for their child’s college education. When you are worried about meeting your family’s day to day needs, a college savings account can seem impossible. That’s why I am excited to partner with Upromise by Sallie Mae to share some simple and practical ways you can start saving for your child’s college education today. I received compensation from Upromise in exchange for writing this review. Although this is a sponsored post, all opinions are my own.

We want our kids to go to college or trade school, because we know that it is the best way to ensure that they can get a good paying job when they are adults. The problem is, college is expensive. It is only getting more and more expensive every year. There are simple things to know when you are trying to save for college.

Saving for College Tips

Savings Account for Education: I know first-hand how daunting the task paying for college can be, and have learned that nothing motivates you to save more than the ability to visualize and track your specific goals. Upromise GoalSaver is a no-fee, no minimum balance savings account that serves as the perfect entryway for families looking to save for college and other goals. Upromise GoalSaver makes it easy to set up multiple goals, track your progress, move money simply, and give your entire family the opportunity to share in the experience. It also rewards you with a competitive interest rate and cash bonuses for setting up automatic deposits plus an additional 10% cash back on Upromise rewards.

Take advantage of shopping rewards programs: Shopping reward programs like Upromise by Sallie Mae are a great way to save money for college. Upromise is free to join and you can earn up to 5% cash back toward college on things that you are buying anyway. With retailers like Forever21.com, EA.com and Sephora.com, and 850+ online stores, 10,000+ restaurants and 20,000+ grocery and drugstores.it is easy to see how the cash back can add up quickly.

Also, with Upromise, users can earn an additional 5% when shopping online with the Upromise MasterCard, totaling up to 10% savings. Users can transfer earnings into a GoalSaver account, apply earnings to eligible student loan repayments, request a check for cash to buy books and other expenses, and even split up earnings across multiple kids. To date, Upromise members have earned $900,000,000 and counting.

Start Early and Save Often: It is best to start saving for college as soon as you know you are expecting. That being said, it is never too late to start. Every little bit that you save for college is less that you have to worry about come college time. Commit to putting something away with each paycheck and you will be surprised how quickly it can add up. By starting early, your savings can accrue interest, which means that your money is working for you. The best way to save, no matter when you start saving is out of sight out of mind. If you have direct deposit, have a little deposited into your savings automatically. If you don’t, get in the habit of taking it out and depositing it right away each time you cash your check.

Don’t Waste that Money: If you tighten your budget and stop spending on those things that you don’t really need, you will have more money to add towards a college fund. By getting a hold on your budget, you will see where you are spending your money and where it is easy to cut from.

There’s an App for that: Use apps that make it easier to manage your finances. You’ll always be able to check your accounts, stay up to date on your balance, and see where you are spending. There are budgeting apps that can help you see where your money is going.

Give the Gift of an Education: Saving for college is hard and for some families, it is hard enough to pay the bills, let alone think of saving for college. Why not help out? In lieu of giving gifts for their birthday, holidays or graduation gift, give to their college fund. As a parent, ask people to make a donation instead of buying a gift. It is an easy way to grow the college fund effortlessly.

Borrow Responsibly: No one wants to start off their adult life with college loans. But if you have to borrow for college, do so responsibly. Understand how much you’ll owe after school and know the terms of the loan. Make sure that the future payments are clear and that you are comfortable with them.

These are all great tips! The cost of college is so scary but it’s important to us to pay for our kids to go to college.